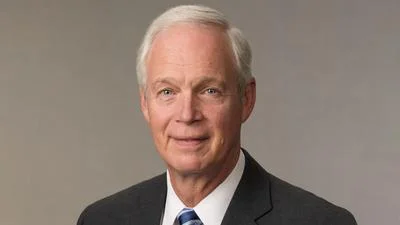

Michael J. Hsu, FDIC Board of Directors - Acting Comptroller of the Currency | upload.wikimedia.org

Michael J. Hsu, FDIC Board of Directors - Acting Comptroller of the Currency | upload.wikimedia.org

These bank failures have resulted in a significant financial loss of $179.6 million, while holding $1.2 billion in customers' deposits and the bank's total assets of $1.3 billion.

The most significant and financially damaging bank failure occurred in Milwaukee with Guaranty Bank. It occurred in May 2017, resulting in a substantial loss of $132 million. At the time of the failure, the bank held a significant amount of $1 billion in customer deposits.

There have been 131 bank failures across the country since 2012, accounting for an estimated loss of $44.3 billion. That averages about 2.6 bank failures per state, which lags behind Wisconsin's total of four during the period.

Silicon Valley Bank was shut down in March 2023 after significant losses and widespread withdrawals. The collapse, estimated at about $20 billion, was the largest U.S. bank failure since Washington Mutual in 2008. After an agreement with the FDIC, First Citizens Bank took over Silicon Valley Bank’s assets and operations.

Alerts Sign-up

Alerts Sign-up